The rapid development of technology is affecting every aspect of our lives. This development has spread to all fields of finance, e-commerce, education, and art by the influence of globalization

The possibilities of the Blockchain are enormous and it seems that almost any industry that deals with some sort of transaction, and security which would mean any industry, can and will be disrupted by the Blockchain.

The blockchain ledger is a publicly-verifiable record that can be used to confirm that both the financial analysts and content producers on our system have been compensated for their contributions. Research consumers looking for premium reports that is in the Research Marketplace section will also have the confidence that payments have gone towards the content producer for the selected reports, with a dependable system-of-record always available as an accounting of their usage.

One of this platform adopting blockchain technology is TRADERISER

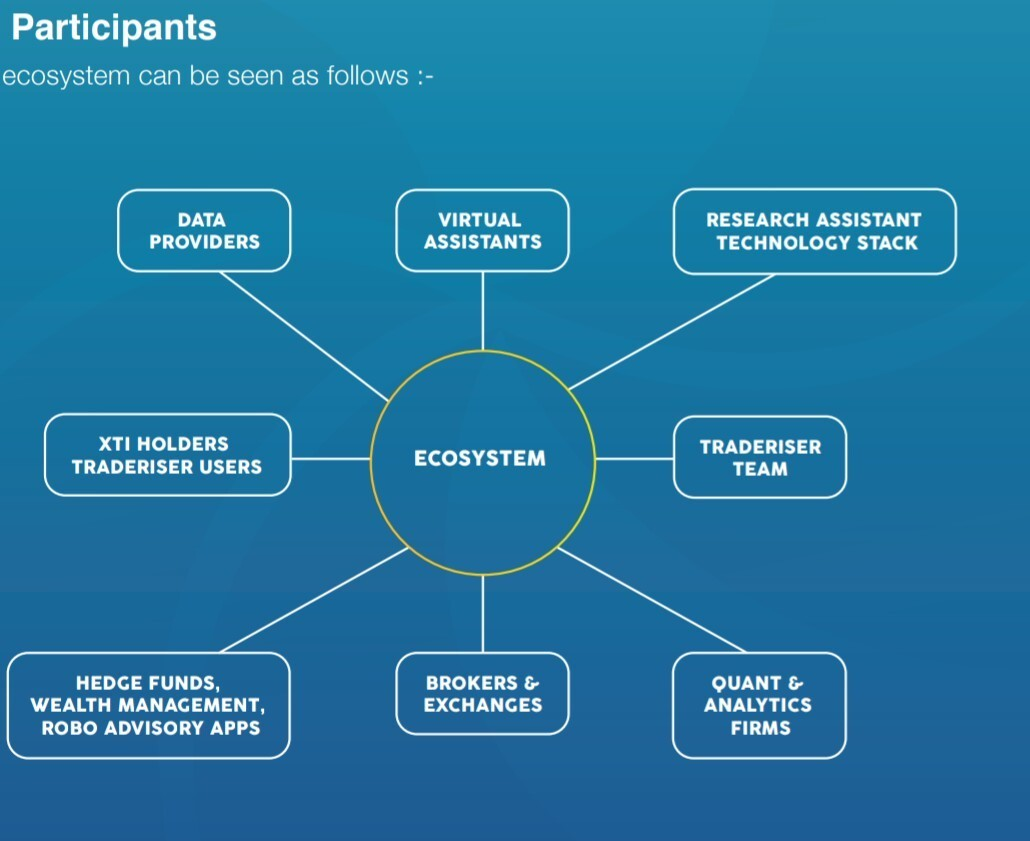

TradeRiser is an artificially intelligent Research Assistant, that can answer simple and complex trading questions. To train the artificial intelligence we will be leveraging the blockchain to build an incentivization system, which will be supported and fed by data from a large network of quantitative analysts and researchers. A token based economy called XTI will be introduced, to incentivize researchers, for their data and contributions to the platform

TradeRiser builds an AI-based Research Assistant, which can answer simple questions and complex trade questions. Financial professionals around the world spend a lot of time and money in research trying to answer these trade questions. This type of research is usually time consuming, inefficient, vulnerable to information overload and requires a lot of manpower. These problems are exacerbated by the emergence of cryptocurrency and financial professionals who want to trade it, in addition to traditional securities. Rapid explosion of cryptocurrency has left many other technologies catching up, individual traders need an easy way to analyze these asset classes.

In world of trading and investing, the most powerful financial analytics is normally in the reserve of the few. TradeRiser is looking to disrupt this, by democratizing financial data analytics and making it available to the masses. Researching trading ideas and exploring the financial markets is a slow process. What is required is a single source of truth, that can provide instantaneous answers, to trading questions at a large scale. Specifically how the news and events affect asset prices around the world.

The TradeRiser platform will have section with a research marketplace. The research marketplace will have lots of reports created by analysts, these research reports will have content such as charts, data and commentary which have been retrieved from asking the Research Assistant and embedded into the reports. Users will be able to select which report they want to read and by which analyst, they will also be able to rate/vote the analysts. Users will be able to pay for the curated reports using the XTI token, which will be paid to the analysts

THE TOKEN SPECIFICATION AND SALE DETAILS.

● Hardcap : $23,000,000

● Total token supply : 500,000,000 XTI

● Token type : ERC20

● Purchase methods accepted: BTC and ETH

PRE – ICO

ROUND VALUE : 1 XTI = $0.07

ICO

ROUND VALUE : 1 XTI = $0.10

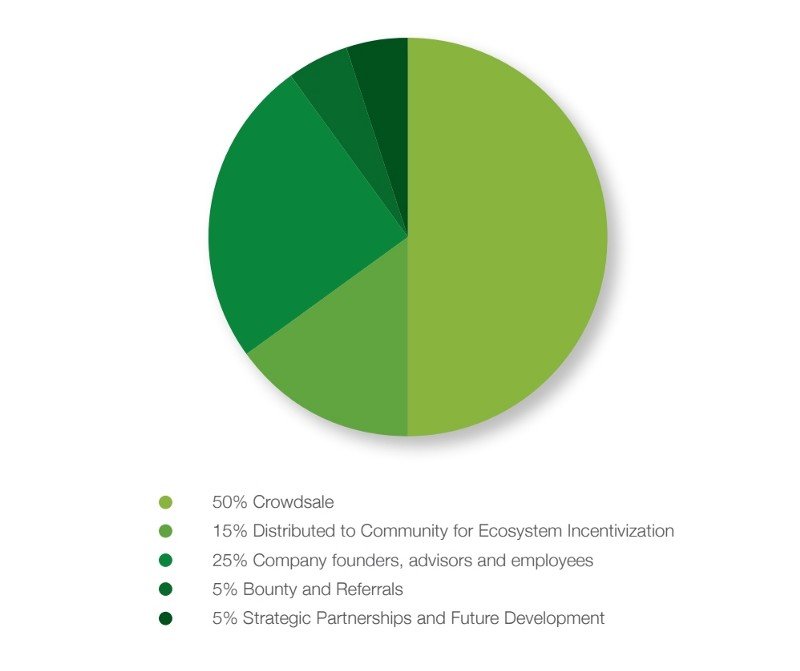

XTI Supply : XTI will have a supply with nominal value USD 23,000,000.

XTI Refund: In certain cases, XTI may be refunded to platform participants. For example, use cases may arise that will necessitate a refund, but typically will follow a minimum period of 3 weeks before this takes place

The token will be based on Ethereum blockchain and the Ethereum smart contract

Employee allocation of XTI will have a vesting period of 24 months, with a 6 month cliff.

Allocation will be proportional to the tenure of each employee by the date of token sale.

Unsold tokens will be burnt.

TRADERISER ROADMAP

2014 to 2015

TradeRiser is founded

2016 Q1 to 2016 Q3

Private Beta/Alpha test with traders and asset managers

2017 Q1

Participated in the Accenture Fintech Innovation Lab London

2017 Q2 to 2017 Q3

Platform UI redesign and functionality improvement

2018 Q3

TradeRiser ICO

2018 Q3 – 2018 Q4 (June – Dec)

Growing The Team and Market Data Provider Partnerships

2018 Q4 (Oct – Dec)

Launch training portal

2018 Q4 (Oct – Dec)

Launch Community Edition of TradeRiser

2019 Q2 (Apr – June)

Hedge Fund and Financial Institution Partnerships

2019 Q4 and Beyond

Launch Research Marketplace and Enterprise Edition

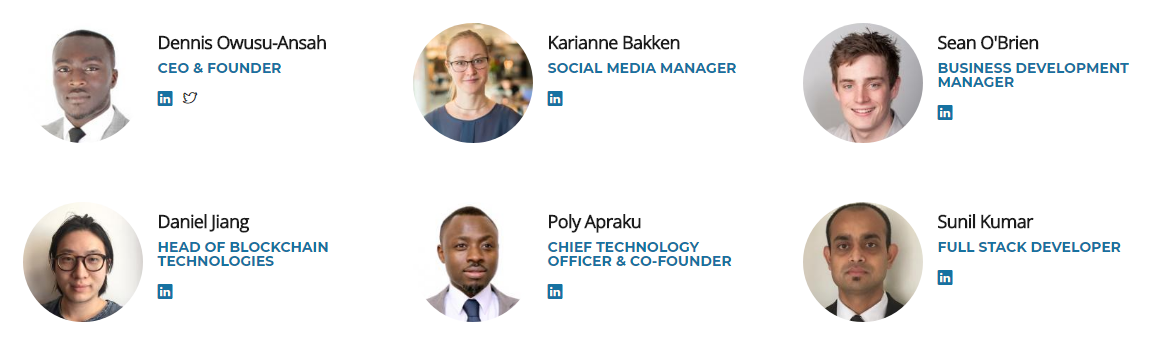

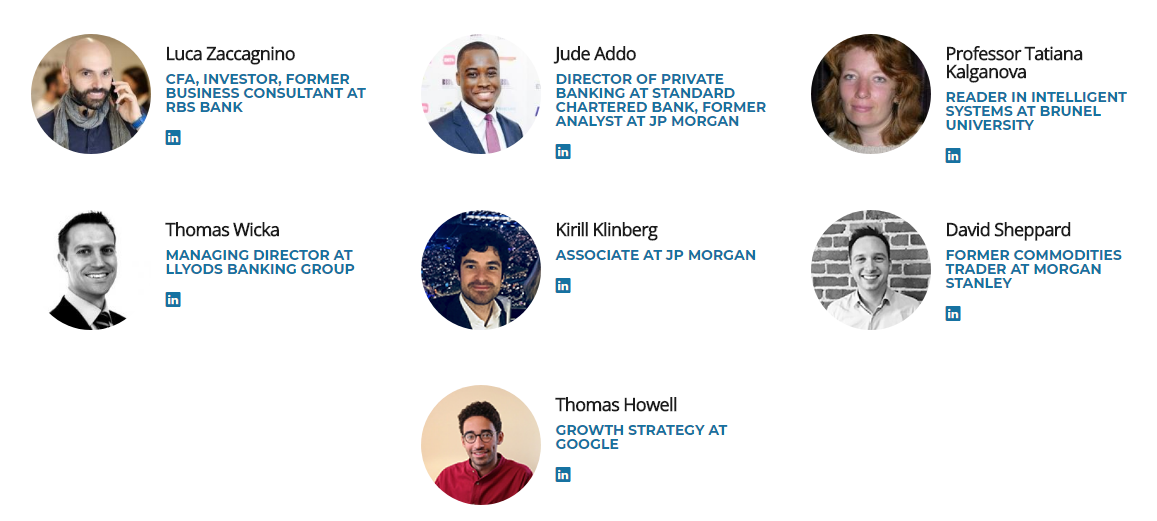

THE TEAM MEMBERS

For more information, please visit:

Website: https://www.traderiser.com

Whitepaper: https://www.traderiser.com/sites/defaul ... ePaper.pdf

LightPaper : https://www.traderiser.com/sites/defaul ... tPaper.pdf

Twitter: https://twitter.com/TradeRiser

Telegram Group: https://t.me/traderiser

Bitcointalk ANN: https://bitcointalk.org/index.php?topic=3835944.0

Written originally by:

Btt profile link: https://bitcointalk.org/index.php?actio ... ;u=1328628

Eth address : 0x32F1EF668ae62A10c000dBAE41909A7d9d8D4684