Hi crypto_investor!Hey Tuur!

I entered bitcoin at the end of 2012 and been following your talks and writings. I very much enjoy the Austrian Economics you bring to your reasoning on BTC. You are also an investment adviser, so let me ask some questions on that topic

Glad to hear you've been enjoying my presentations & writings

See page 15 and 16 of our free report about that: "How to position for the next rally in Bitcoin"What do you consider to be a good % of exposure one should have towards BTC in their portfolio?

I know this is probably dependent on the personal situation of the investor, but maybe you can give general advice.

In summary, my thoughts:

- Bitcoin as an insurance: 1-2% of financial assets

- Bitcoin in a speculative portfolio: 2-5% allocation

- Bitcoin as a bet on early retirement: 5-10% of financial assets

(about the latter, be sure to read all the caveats in the report)

I have liked Litecoin since I first learned about it, because it offers similar utility as the Bitcoin network, and therefore can be seen as a 'backup network' for Bitcoin. A 'silver' for Bitcoin's 'gold', as is often said.Personally I have a big % of my net worth in BTC, but that is due to the exponential growth of the BTC value

I always steered clear of altcoins. I never really saw the innovation. I did had a small speculative position in LTC. Sold a lot during the LTC bubble (most of them > 0.04 BTC). I sold the remaining part of my stash once the rumors on the scrypt ASIC started to surface. Reason: LTC's USP was a more decentralized mining algorithm. Everybody with a GPU could mine, so that created a community. But since the scrypt ASICs, there is fundemantally no difference between BTC and LTC in my opinion.

What is your opinion on investing in LTC? Are there any altcoins you are following?

Other arguments for having at least a little LTC exposure, in my mind:

- it's the number 2 in market cap: $150 million as of today

- the most liquid altcoin (highest volumes on exchanges)

- has a unique price relationship to Bitcoin, making it an interesting currency for trading

Below is a reflection of my personal Litecoin-Bitcoin trades of the last two years. It's based on my trading history on several exchanges.

Note that my actual profit may be a bit lower due to some unaccounted trading fees. Piecing everything together was pretty grueling, if anyone has tools to make this easier I want to hear about them!

I think that privacy friendly sidechains will go a long way to solve fungibility issues in Bitcoin.Personally, I think that this quote is very relevant on the topic:

Yes I have certainly heard about Monero, it's one of the altcoins I am researching for our newsletter. Roeland Creve has been generous in providing me with info about it.If you ask me, Monero is a very good altcoin to hedge a bit. Why you may ask?

*Monero solves the fungibility issue. This coin has stealth addresses (hides the receiving address, balances are unlinkable), ring signatures (hides the history of the coins making them untraceable) and will likely implement Confidential Transactions (hides transaction amounts, money flows become completely opaque) as well while preserving a transparent emission (unlike zerocash).

*Monero also has a dynamical block size limit, making it a good hedge in case this becomes a real problem in BTC.

*And last but not least, it has a completely different codebase than BTC (unlike DASH for example) making it a good hedge in case some problem with the BTC code would arise (Monero uses for example a completely different elleptic curve than BTC)

So my final question is simple:

have you heard about Monero and do you think it's a good hedge for BTC? What percentage would you advice to hold?

Personally I diversified 10% of my BTC in XMR because I feel that this could become a complementary coin to BTC.

I am very excited about the different technological innovations we've seen in the altcoin space, and I work to keep track of them. One of the questions I keep asking myself is which ones will be incorporated in sidechains, and which ones will function best in standalone alt-blockchains.

Forum rules

The more people that are involved, the more interesting this AMA series will be for everyone.

Please help spread the word of this amazing AMA series on your own social media. (YES, EVEN YOURS!)

Short URL: AMA.Bitcoin.com

Hashtag: #BTCAMA

When the AMAs are finished, all the answers will be compiled into a free E-book!

The more people that are involved, the more interesting this AMA series will be for everyone.

Please help spread the word of this amazing AMA series on your own social media. (YES, EVEN YOURS!)

Short URL: AMA.Bitcoin.com

Hashtag: #BTCAMA

When the AMAs are finished, all the answers will be compiled into a free E-book!

- Tuur Demeester

- AMA

- Posts: 19

- Joined: Sun Oct 18, 2015 3:17 am

- Location: Americas

- Contact: Website Twitter

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

Fiat justicia, ne pereat mundus — Ludwig von Mises

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

-

binaryFate

- Posts: 1

- Joined: Mon Sep 28, 2015 5:13 pm

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

Hi Tuur and thanks for the AMA,

Would you have advised Bitcoin as you did, back in the day, if you had the cautionnary mindset you seem to have today with respect to fungibility issues?

The reason I'm asking is the cautionary stance you seem to take w.r.t. fungibility and the false (I'm affirmative here) assumption that sidechains might be a solution. Even without diving into the technical aspects, it is trivial that sidechains offering confidential aspects would not increase the overall fungibility of Bitcoin. (it's still visible if some coins went through the "anonymizer" sidechain, leaving anyone the possibility to take decisions based on that).

I am aware my question might be understood as slightly passive-agressive. If you feel so, please don't take it personally and consider it in a broader context: in your opinion, is it possible/often the case that early Bitcoin adopters adopt over time the very same type of tunnel vision (towards Bitcoin, and against anything else) they were happy to not have (towards fiat for instance) when they found out about Bitcoin?

Would you have advised Bitcoin as you did, back in the day, if you had the cautionnary mindset you seem to have today with respect to fungibility issues?

The reason I'm asking is the cautionary stance you seem to take w.r.t. fungibility and the false (I'm affirmative here) assumption that sidechains might be a solution. Even without diving into the technical aspects, it is trivial that sidechains offering confidential aspects would not increase the overall fungibility of Bitcoin. (it's still visible if some coins went through the "anonymizer" sidechain, leaving anyone the possibility to take decisions based on that).

I am aware my question might be understood as slightly passive-agressive. If you feel so, please don't take it personally and consider it in a broader context: in your opinion, is it possible/often the case that early Bitcoin adopters adopt over time the very same type of tunnel vision (towards Bitcoin, and against anything else) they were happy to not have (towards fiat for instance) when they found out about Bitcoin?

Last edited by binaryFate on Thu Nov 26, 2015 9:18 pm, edited 1 time in total.

- Tuur Demeester

- AMA

- Posts: 19

- Joined: Sun Oct 18, 2015 3:17 am

- Location: Americas

- Contact: Website Twitter

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

Hi nyeko_12,Hi Tuur!

What is your opinion regarding LN-network,BIP 100 (increasing the blocksize first to 2mb -> 4mb --> 8 mb--> 32mb) & 101?

Do you think this block-size issue can be resolved by December (thinking of Combining the LN-network with BIP 100)?

What do you think of bitcoin future?

I don't have a detailed technical opinion on the different block-size alteration proposals, though I do think in general for the long run security and health of the Bitcoin network, a smaller block size is preferable over a larger block size.

The Bitcoin blockchain will never be and does not need to be a Visa-like network. I see the purpose of the main chain as a value anchor rather than a payment network. I see it as evolving towards a network of big gold vaults rather than a ledger everyone uses for paying a beer and tipping. The latter type transactions will happen on sidechains or via off-chain transactions (exchanges & online wallets), possibly facilitated by lightning network technology.

For an analysis of the block size debate (slightly outdated, although I think the main points still stand), see our report "Sizing up the Block Size Debate". The report concludes with "I anticipate that the block size limit increase will be implemented into the blockchain in spring 2016."

I think the future for Bitcoin is incredibly bright! I believe it is a seminal technology that will change the course of history for the better, in that it will make future generations wealthier, diminish the occurrence and impact of economic crises, and that it will substantially contribute to a decrease of physical violence in society.

Fiat justicia, ne pereat mundus — Ludwig von Mises

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

- Tuur Demeester

- AMA

- Posts: 19

- Joined: Sun Oct 18, 2015 3:17 am

- Location: Americas

- Contact: Website Twitter

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

Hi Chris,Hi Tuur,

Full disclosure, this question is a shameless plug:

Have you (or are you) considering submitting any of your research to our new peer-reviewed journal Ledger? Also, it would be great to hear your thoughts on the role that academics can play in the evolution of Bitcoin/cryptocurrencies.

I don't have any plans for doing academic research for the moment, so no. Ledger looks like a great place for publications though!

As for the potential role of academics in the evolution of Bitcoin & cryptocurrencies, I don't see a significant one.

Last year I attended the largest free market academic conference (APEE, in Las Vegas). I thought this would be a place where one can to learn about how the scientific thinkers in favor of free trade and private money have been working to at least incorporate the advent of cryptocurrencies into their theories. Yet I was very disappointed: whereas most people had heard about Bitcoin, hardly anyone was interested in it or seemed to know how it worked. The two presentations I attended that were somewhat focused on Bitcoin were from people that had only a rudimentary knowledge of the technology.

You should perhaps know that I'm a university dropout myself. During my years in the think tank world, I became convinced that in general, academia chases innovation rather than producing it. I may be biased because I attended mostly "soft" science classes in the very bureaucratic universities of Belgium, things might be different in private universities with more of a hard science bent.

Still, until I get convinced otherwise, my very crude and biased suggestion to people in academia is: get your degree (or not) and then work towards stepping down from academia in favor of entrepreneurship!

Fiat justicia, ne pereat mundus — Ludwig von Mises

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

Do you think people who hold their wealth in Gold/Silver should be threatened by "asteroid mining"?

https://twitter.com/AsteroidEnergy/stat ... 6581107712

https://twitter.com/AsteroidEnergy/stat ... 6581107712

- Tuur Demeester

- AMA

- Posts: 19

- Joined: Sun Oct 18, 2015 3:17 am

- Location: Americas

- Contact: Website Twitter

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

Hi Hazir,hello Tuur! greetings.

1)i'm working on building for the first time my investment portfolio, i have a 2.5% of my capital in bitcoins, and am planing to rising it to about 6%, what i'm wondering is this - if i get lucky and bitcoin rises many-fold as hoped, it will become a bigger and bigger percent of my investment , what are you thoughts on taking out profits and scaling out in this gradual scenario? what percent of profit taking would you consider wise at what point? (i will not take this as individual investment advice! just curious to hear your personal thoughts )

i guess that if i'm betting on a high profit in case of mainstream bitcoin adoption, i should cash out profits in according to the stage in adoption ,right?

How and when to take profit in Bitcoin is a difficult subject to comment about. It depends on your age, time horizon, your conviction level, your individual financial situation, your legal situation (are capital gains taxed in your country?), and so forth.

If you have a rebalancing approach to investing, the answer is quite simple I think: at the end of the year, trim down your Bitcoin allocation (i.e. buy or sell) until it again represents the desired percentage in your portfolio (in your case that seems to be 6%).

If you are a passive investor, you 'buy and hold', only to trim off your Bitcoin holdings annually with what you'd otherwise expect to receive as dividends on stocks, or interest payments on bonds.

If you have a more active approach to investing, you might want to gradually sell into the rally (if you don't trust your ability of 'calling' the top), or you might want to sell on the way down, when the markets crash and then bounce back but not above the previous high.

Personally, although I do over time want to diminish my exposure to Bitcoin, have more of a buy and hold approach.

The block halving is yet to come (cutting the supply of new BTC in half from 3600 BTC / day to 1800 BTC / day, and I think prices will likely rise in anticipation of that event.2)what are your thoughts on the current price of a bitcoin (320$~), do you tend to think it's a symptom of the block halving?

The level to watch, imo, is the $300 level. If the price falls below that, we could see another period of consolidation, with prices mostly between $200 and $300. If stays above $300, it will likely serve as the take off strip for a big rally.

Long term: undervalued stock markets (hard to find, but there are a few left in the world), Bitcoin, gold mining shares, tech stocks (after a serious correction), ...3)what areas of short and long term investment do you find interesting currently?

Short term: long USD, some strategic short positions in stocks.

It's hard to say because there are so many fruitful approaches to investing.4)what reading material and advice would you point a new investor to? i'm at the stage of trying to absorb as much information as possible and would be grateful for your input!

Some suggestions that I think have worked for me:

- Austrian School economics for a solid theoretical foundation (see here for example)

- Material that gets you in the mindset and decision making process of great investors (Reminiscences of a Stock Operator, RealVisionTV, etc.)

- Study the history of markets, in particular the history of booms and busts

- Focus on improving self knowledge (therapy, keeping a diary, etc) in order to better understand the emotional aspects of decision making

- Read current analysis of what is happening in the markets. As time progresses and you get to look back, you'll develop sort of a catalogue about which analyses produced correct predictions and which didn't.

Good luck!

Fiat justicia, ne pereat mundus — Ludwig von Mises

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

- Tuur Demeester

- AMA

- Posts: 19

- Joined: Sun Oct 18, 2015 3:17 am

- Location: Americas

- Contact: Website Twitter

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

Hey Tuur,

I guess you will be more happy than others with the the question since you are first an investor.

I was re-reading Antifragile by iconoclast thinker Nassim Taleb recently. He writesHaving met or read about a few people in the bitcoin community, I have come to think it's a very relevant question and you can better weight their opinions having an idea of how many Bitcoins they hold (or do not hold.)"Never ask anyone for their opinion [...] Just ask them what they have -or don't have- in their portfolio"

In 2014, the world gold production was 2,860 metric tonnes. In troy ounces, and multiplied by the gold price: 9.1951e+7 * 1,072 = $ 98,571,472,000 worth of gold, or $98 billion.Since you are kwown to be sceptic about the current monetary policy in most of the world:

- What do you think of gold in an environment where Bicoin would be rising ? At what point (market cap) Bitcoin starts to seriously compete with gold and grabs some of its marketshare as a store of value / hedge against monetary risk ? (I think now it works more as an investment with a high risk/reward profile akin to an option).

For the next four years, the amount of new bitcoin being produced by miners will be about 657,000 per annum. For that to become worth 10% of the annual gold production, the value of 1 BTC would have to rise to $240,000 $13,700. (edit: thanks for [url=https://forum.bitcoin.com/ama-ask-me-anything/i-m-tuur-demeester-bitcoin-investor-economist-and-founder-of-adamant-research-ask-me-anything-t2911-30.html?sid=00159c859cb348205f7347c236ff9090#p9676]pointing out[/url] my miscalculation)

But that is not how psychology works I think.

I see societies overall as fairly inert, reluctant to embrace change. Seeing that physical gold is structurally undervalued (because of the fractional reserve nature of the paper market for gold) and that its history as a store of value is deeply ingrained in many cultures, I think it would take quite a lot before we see significant erosion of the gold price because of Bitcoin.

I think we'd first need to see the cycles in Bitcoin to seriously lengthen, to 5-10 years or so.

A black swan scenario that would play out badly for gold is if meteor or seafloor mining seriously take off and the world is flooded with cheap gold.

I think the bubble and the fraud is in fiat, and that when the 'crack up boom' happens (devaluation, hyperinflation), value will flow to both Bitcoin and gold. That's why I'm bullish on both.

I think it's an opportunity for the new regime (if it actually gets elected) to push through reforms a la Thatcher, with privatisations, lower government spending, and a stabilization of the currency. I think Argentina could become a better place to live and work (although that won't change overnight), and very investable, somewhere in the next 5 years.What do you think of the result of the presidential election in Argentinia ?

Bitcoin over time will diminish the effect of the election cycle, because when a country is on a private money standard, its government can't just print money to cover expenses. It is forced to somewhat live within its means.

Last edited by Tuur Demeester on Thu May 30, 2019 5:39 pm, edited 4 times in total.

Fiat justicia, ne pereat mundus — Ludwig von Mises

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

- Tuur Demeester

- AMA

- Posts: 19

- Joined: Sun Oct 18, 2015 3:17 am

- Location: Americas

- Contact: Website Twitter

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

Thanks for having me! It's been fun and interesting so farHi Tuur,

Thanks for joining bitcoin.com. The links are great too. I will have to read alot today

I don't disclose how I store my bitcoins personally, but in our report we recommend Xapo and Bitcoin Trezor. I hear the Open Bitcoin Privacy Project is soon coming out with new ratings of bitcoin storage solutions, so you may want to keep an eye out for that.1) How do you store your coins? Can you give new members some tips on that?

In general, here are some pointers for safe storage:

- Try to diversify your risk, don't store all your eggs in one basket

- Write down your storage and retrieval procedure, talk it through with an expert

- Build in fail safes (multi sig can be useful in this regard)

- Consider that your brain might represent a risk: most coins have not been stolen, but were lost due to a forgotten password.

- Keep in mind that there will likely be more exchanges and bitcoin wallets hacked in the future.

- Open source software, on average, tends to be more robust and reliable.

Many things!2) What are you working on at the moment?

- getting the Adamant Newsletter (subscription based investment newsletter) on the physical rails, doing a lot of development and testing

- working on several new reports, exciting stuff!

- continuing to educate myself on investing and portfolio management

Yeah, I'll be presenting at the Latin American Bitcoin Conference next week. I'm taking it a bit slow with presentations lately because of all the preparations for the newsletter.3) You did alot talks about BTC in the past all over the world. Are you planing to attend on BTC conferences again and give some talks?

Sidechains.4) What is the most exiting thing that is happening right now in the bitcoin sphere?

Fiat justicia, ne pereat mundus — Ludwig von Mises

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

- Tuur Demeester

- AMA

- Posts: 19

- Joined: Sun Oct 18, 2015 3:17 am

- Location: Americas

- Contact: Website Twitter

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

Hi Jordan,Hi Tuur, I've been following you on Twitter for quite sometime and really enjoy reading your thoughts. I just read your report and already sent the link to some family members.

I'm getting into economics. So far I've read Economics in One Lesson, and What Has Government Done to Our Money. What other books do you recommend for learning the basics of Austrian economics?

What are your current thoughts on the bitcoin price and what do think will happen in the next ~12 months?

Great that you like our report, and thanks for sharing it!

Books I recommend for learning the basics of Austrian economics, let's see.

As far as books for beginners, I really enjoyed Gene Callahan's 'Economics for Real People'.

My approach to learning economics has been a little different than starting with primers. I'd try to find who I thought was the most learned person on the subject, and then I started reading his works. Sometimes it would be a paper, or a chapter in a book of his. The learning curve that way is pretty steep, but I like that it can help avoid 'oversimplification bias'.

Also, I have a heart for philosophy and honing my perspective on the world, and so I focused a lot on methodology, after which I moved on to basic economic concepts, and a study of economic history.

My journey into Austrian Economics looked like this:

I read Mises' Human Action (was actually the first thing I ever read of the Austrian school), and then also his 'Theory and History' and the wonderful 'Bureaucracy'. Then I used Rothbard's 'Man, Economy and State' as a reference work to use whenever I had trouble grasping a concept or an approach.

I studied several of Hayek's papers and started reading some of his books, but I found him lacking in clarity at times, and pretty exhausting to read.

All in all I didn't read that many books, because I didn't have money to buy them!

I did spend hundreds of hours listening to recorded lectures by Mark Thornton, Hans Hermann Hoppe, Robert P. Murphy, Murray Rothbard (he was an amazing lecturer!), David Gordon, Walter Block, Guido Hulsmann, Yuri Maltsev, Tom Woods, Tom Dilorenzo and Jeffrey Tucker.

I also had stacks of papers that I printed out on my little printer, revolving around the subject I was interested in at the time. Authors that come to mind are Philipp Bagus, Stephan Kinsella, Roderick T. Long, Rothbard, ...

What was amazing about living in Ghent, Belgium, is that we had professor Frank van Dun to learn from. His knowledge about philosophy of law is bar none (he pretty much discovered argumentation ethics in the early eighties) , and he is also incredibly well versed in Austrian Economics. We organized dozens of lectures with him, and he was always generous with giving us thoughtful feedback on whatever we were working on.

Ha, I got a bit carried away! Hope this helped

For my response to "how do you see the price of Bitcoin faring over the next twelve months?", see here: http://ow.ly/V6OF0

Fiat justicia, ne pereat mundus — Ludwig von Mises

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

- Tuur Demeester

- AMA

- Posts: 19

- Joined: Sun Oct 18, 2015 3:17 am

- Location: Americas

- Contact: Website Twitter

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

Hi edugarbizu,Hey Tuur,

could you tell us more about Adamant Research?

- What is the business model?

- How it profits?

- What´s your role on it?

- Future plans?

Thanks

Thanks for asking!

Adamant Research is a small research firm, founded by myself and my fiancé Becca Packard. I'm editor-in-chief, she is the managing editor. Our main product is the Adamant Newsletter, which is a subscription based investment newsletter.

Business model is simple: we provide investment research and ideas that pay themselves back, and our subscribers provide us with income that we use to further improve upon our research.

If you're interested in following what we do, and you want to know when we launch, sign up at adamantresearch.com.

Fiat justicia, ne pereat mundus — Ludwig von Mises

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

- Tuur Demeester

- AMA

- Posts: 19

- Joined: Sun Oct 18, 2015 3:17 am

- Location: Americas

- Contact: Website Twitter

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

You're welcome, I'm flatteredHi Tuur,

Thanks for doing this AMA and for providing such valuable information and advice. You play a very important role in the bitcoin ecosystem, by looking at the cryptocurrency phenomenon from various perspectives, sending info and grounding other investors. Thanks

I suggest going to coinmarketcap.com and having a look at the top 20. The guys at CoinGecko have developed some great, free metrics to look at the various altcoins.You recommend roughly 6% to be invested in altcoins. What are some 4-5 significant altcoins worth researching?

For more thoughts on cryptocurrency protocols, see our report.

Ceteris paribus I would say before the halving. Speculators tend to anticipate events. But there are many more factors than just the halving, so we'll have to see.Also - do you think the next bitcoin bubble will start before or after the halving? What is the approximate range for the top of the bubble? No predictions just opinion

As for the top of the next bubble, if it comes, I honestly have no idea. On the high end I find myself talking about $3,000, on the low end $1,000. Determining the top of the bubble is better done using ways to gauge sentiment, in my experience. The level of exhuberance in the media and on forums will often tell you more than a price chart.

Fiat justicia, ne pereat mundus — Ludwig von Mises

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

- Tuur Demeester

- AMA

- Posts: 19

- Joined: Sun Oct 18, 2015 3:17 am

- Location: Americas

- Contact: Website Twitter

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

Hi Dallas,Hi Tuur,

Excellent report!

In the report you said, "There are four prominent risks associated with Bitcoin" and the fourth risk you list as, "a sustained attack by an organization with substantial financial resources (such as a government)."

I'm wondering what are your thoughts on the idea of government not just attacking it, but actually outright banning it. I tend to agree that attacking is probably not a big concern, but governments can take it a step further because they have the power of law. Now ultimately I don't think it will matter, just as laws haven't stopped Bittorrent and file sharing, but do you think it could scare enough people off that mainstream adoption would take considerably longer?

Thanks! Dallas

I agree with you on the impossibility of a government ban. If that were to happen, I do also think that it would substantially hinder mainstream adoption, at least for a number of years. For more, see my response to "What is the biggest challenge that Bitcoin faces right now toward gaining more user adoption?": http://ow.ly/V76G3

Fiat justicia, ne pereat mundus — Ludwig von Mises

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

- Skin_in_the_game

- Nickel Bitcoiner

- Posts: 54

- Joined: Thu Nov 19, 2015 6:51 pm

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

Thanks for the answer. Your calculation seems off no? For 10% of the gold production, I have 1 btc at 15 000 USD (98,571,472,000x0.1/657000).Hi Skin_in_the_game. That's a great question!Hey Tuur,

I guess you will be more happy than others with the the question since you are first an investor.

I was re-reading Antifragile by iconoclast thinker Nassim Taleb recently. He writes Having met or read about a few people in the bitcoin community, I have come to think it's a very relevant question and you can better weight their opinions having an idea of how many Bitcoins they hold (or do not hold.)

I'm now asking every participant the same question:

- Do you mind to tell us which percentage of your net worth and/or liquid assets you hold in Bitcoins ?

Back in 2012 I invested some 7% of my financial assets into Bitcoin. Currently I have a +70% exposure to Bitcoin-the-currency. This concentration would have been lower had I been more practically prepared for the rally in late 2013. I plan to diversify my holdings during the next rally in Bitcoin.

In 2014, the world gold production was 2,860 metric tonnes. In troy ounces, and multiplied by the gold price: 9.1951e+7 * 1,072 = $ 98,571,472,000 worth of gold, or $98 billion.Also for you I have another question since you are kwown to be sceptic about the current monetary policy in most of the world:

- What do you think of gold in an environment where Bicoin would be rising ? At what point (market cap) Bitcoin starts to seriously compete with gold and grabs some of its marketshare as a store of value / hedge against monetary risk ? (I think now it works more as an investment with a high risk/reward profile akin to an option).

For the next four years, the amount of new bitcoin being produced by miners will be about 657,000 per annum. For that to become worth 10% of the annual gold production, the value of 1 BTC would have to rise to $240,000.

- Tuur Demeester

- AMA

- Posts: 19

- Joined: Sun Oct 18, 2015 3:17 am

- Location: Americas

- Contact: Website Twitter

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

Hi binaryFate,Hi Tuur and thanks for the AMA,

Would you have advised Bitcoin as you did, back in the day, if you had the cautionnary mindset you seem to have today with respect to fungibility issues?

The reason I'm asking is the cautionary stance you seem to take w.r.t. fungibility and the false (I'm affirmative here) assumption that sidechains might be a solution. Even without diving into the technical aspects, it is trivial that sidechains offering confidential aspects would not increase the overall fungibility of Bitcoin. (it's still visible if some coins went through the "anonymizer" sidechain, leaving anyone the possibility to take decisions based on that).

I'm not sure if I understand your first question, but I'll give it a go.

I think that perfect fungibility of an asset is virtually impossible, and not necessarily desirable. What matters is sufficient fungibility, and I think that Bitcoin has that in spades. What is the problem that you see Bitcoin run in to? That we get different classes of coins, some blacklisted and others not?

This question I understand better! I think it's an important one to consider, thanks for asking.I am aware my question might be understood as slightly passive-agressive. If you feel so, please don't take it personally and consider it in a broader context: in your opinion, is it possible/often the case that early Bitcoin adopters adopt over time the very same type of tunnel vision (towards Bitcoin, and against anything else) they were happy to not have (towards fiat for instance) when they found out about Bitcoin?

I had my frustrations in the gold world (and people like Trace Mayer had similar experiences) trying to convince people of Bitcoin's potential, during which I also encountered a lack of interest and something that could be called tunnel vision. So I think I know what you mean.

Some thoughts on the different kinds of people that "don't see it":

1) the person feels that the 'new thing' potentially threatens their career or social status if he were to embrace it, and therefore he shuns it

2) the person believes the 'new thing' violates the rules that he's internalized, i.e. he doesn't think there can be another paradigm

3) the person is settled in a career and in their network, and simply has less time to research new things

4) the person is right and I am wrong

During the years I've spent thinking about the economy and investing, I've encountered people that fit each of these categories, and combinations of them.

I think it's true that there is a risk that I could develop some kind of a 'Bitcoin tunnel vision'. That's why I try to apply these categories to myself as well: "Do I feel threatened by this?", "Should I be looking more into this? What is the evidence for that?", "Is there another perspective I should consider to appreciate this?", "What are arguments in favor of the 'new thing'?", "Have proponents of the 'new thing' convincingly rebuked my criticisms?".

Fiat justicia, ne pereat mundus — Ludwig von Mises

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

- Tuur Demeester

- AMA

- Posts: 19

- Joined: Sun Oct 18, 2015 3:17 am

- Location: Americas

- Contact: Website Twitter

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

You're right, thanks for pointing it out! I corrected my response now.Thanks for the answer. Your calculation seems off no? For 10% of the gold production, I have 1 btc at 15 000 USD (98,571,472,000x0.1/657000).In 2014, the world gold production was 2,860 metric tonnes. In troy ounces, and multiplied by the gold price: 9.1951e+7 * 1,072 = $ 98,571,472,000 worth of gold, or $98 billion.

For the next four years, the amount of new bitcoin being produced by miners will be about 657,000 per annum. For that to become worth 10% of the annual gold production, the value of 1 BTC would have to rise to $240,000.

Actually $15k for a Bitcoin (market cap ca. $315 billion) does seem like a possible pricepoint at which Bitcoin could start seriously chipping away at global gold demand, especially if the market cap can be held at or above that level for a long period of time.

Fiat justicia, ne pereat mundus — Ludwig von Mises

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

- Tuur Demeester

- AMA

- Posts: 19

- Joined: Sun Oct 18, 2015 3:17 am

- Location: Americas

- Contact: Website Twitter

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

Hi 1love,Do you think people who hold their wealth in Gold/Silver should be threatened by "asteroid mining"?

https://twitter.com/AsteroidEnergy/stat ... 6581107712

I think that is certainly a possibility, although I don't know enough about the practical feasibility of asteroid (of seafloor) mining. If gold is no longer scarce, it will lose its alure. It seems to me that silver is less vulnerable to this threat, because it's so much more bulky: 1 tonne of silver only yields $450,000 in the market today, whereas 1 tonne of gold you can sell for 75 times more money: $34 million.

Fiat justicia, ne pereat mundus — Ludwig von Mises

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

- Tuur Demeester

- AMA

- Posts: 19

- Joined: Sun Oct 18, 2015 3:17 am

- Location: Americas

- Contact: Website Twitter

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

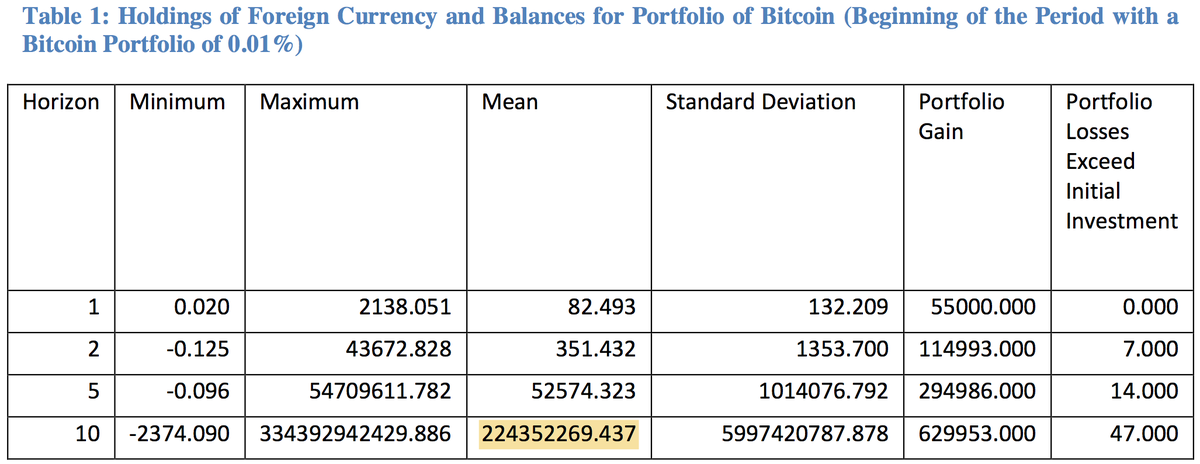

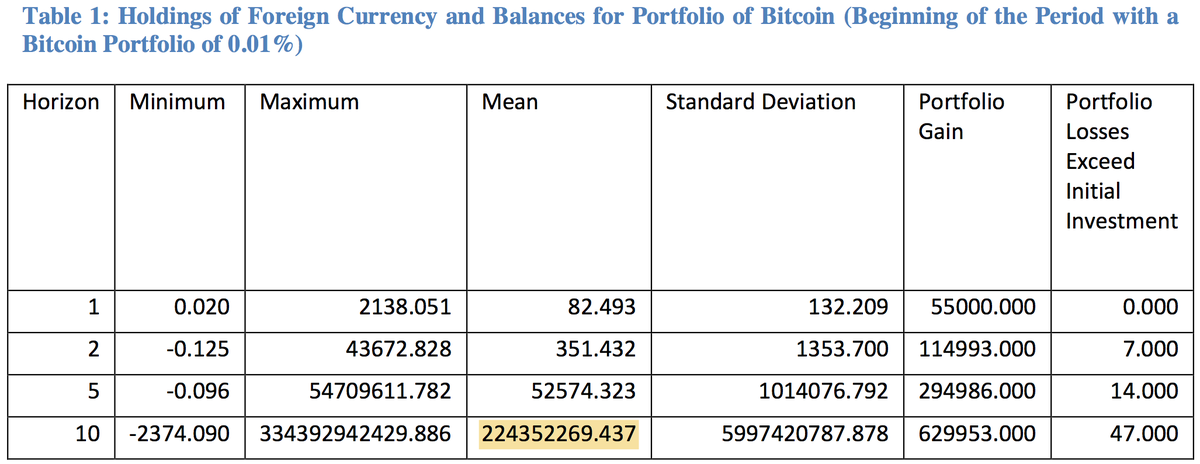

Hi, I thought I'd share this news that came out today, which supports my contention that in the long run, governments will 'buy into' Bitcoin.

Two Barbados central bankers have made the case that Bitcoin should be included in the international currency reserves of the island:

http://www.centralbank.org.bb/news/arti ... l-reserves

The reason why this is a good idea is not only because the value of Bitcoin could go up (and thus benefit the treasury and financial welfare of the country), but also that it provides a buffer to defend a nation against that is known as a "speculative attack".

Why, and how that would work was described in a 2013, which speculated that the IMF will eventually build up a Bitcoin reserve paper:

Imagine the potential of the bitcoin price, and its rise in international credibility, if one central bank after the other allocates even a fraction of a percentage of its reserves to BTC...

- -

Edit: in the paper, the authors project a whopping $224M return on a mere $27k investment!

Two Barbados central bankers have made the case that Bitcoin should be included in the international currency reserves of the island:

http://www.centralbank.org.bb/news/arti ... l-reserves

The reason why this is a good idea is not only because the value of Bitcoin could go up (and thus benefit the treasury and financial welfare of the country), but also that it provides a buffer to defend a nation against that is known as a "speculative attack".

Why, and how that would work was described in a 2013, which speculated that the IMF will eventually build up a Bitcoin reserve paper:

Imagine the potential of the bitcoin price, and its rise in international credibility, if one central bank after the other allocates even a fraction of a percentage of its reserves to BTC...

- -

Edit: in the paper, the authors project a whopping $224M return on a mere $27k investment!

Fiat justicia, ne pereat mundus — Ludwig von Mises

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

Read our free, 17p report: "How to Position for the Next Rally in Bitcoin"

Find me on twitter here: https://twitter.com/tuurdemeester

- BitcoinXio

- Nickel Bitcoiner

- Posts: 167

- Joined: Mon Sep 21, 2015 4:12 pm

- Contact: Website

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

Hi Tuur, thanks for providing your opinion on this. I saw the news earlier too and it makes me quite bullish after reading about it too. One can only hope that this will actually come to fruition in Barbados and other countries to follow.Hi, I thought I'd share this news that came out today, which supports my contention that in the long run, governments will 'buy into' Bitcoin.

Two Barbados central bankers have made the case that Bitcoin should be included in the international currency reserves of the island:

http://www.centralbank.org.bb/news/arti ... l-reserves

The reason why this is a good idea is not only because the value of Bitcoin could go up (and thus benefit the treasury and financial welfare of the country), but also that it provides a buffer to defend a nation against that is known as a "speculative attack".

Why, and how that would work was described in a 2013, which speculated that the IMF will eventually build up a Bitcoin reserve paper:

Imagine the potential of the bitcoin price, and its rise in international credibility, if one central bank after the other allocates even a fraction of a percentage of its reserves to BTC...

- -

Edit: in the paper, the authors project a whopping $224M return on a mere $27k investment!

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

Is it a good time now to get into cryptocurrency (Bitcoin)? Do you think there's an alt-coin (Ripple) can take the #1 spot from Bitcoin?

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

Hello am novice. I have send unconfirmed transactions on my wallet (bitcoinwallet.com) and I am stuck. should I forget about the coins or there is a way i can get it back? I have tried to reserach of child pays for parents and replacement methods but I do not seem to get anywhere with the wallet am using. While we are at it could you recommend a good bitcoin wallet.

Re: I'm Tuur Demeester, Bitcoin investor, economist and founder of Adamant Research. Ask me anything! (AMA Nov 26)

What is your opinion on crypto dividends?

Whichever chain wins,the world wins

Return to “AMA - Ask Me Anything”

Who is online

Users browsing this forum: No registered users and 1 guest